One Of The Best Tips About How To Avoid Tax Evasion

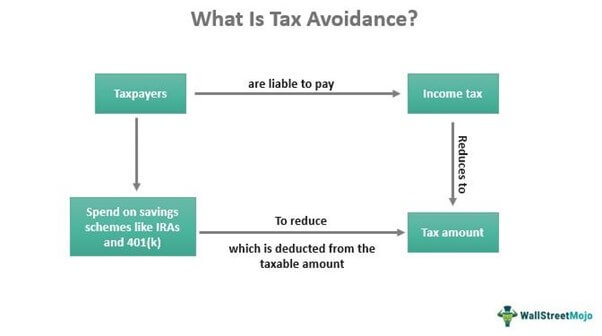

Tax avoidance is not illegal and involves taking steps, within the law, to minimise tax payable (or maximise tax reliefs).

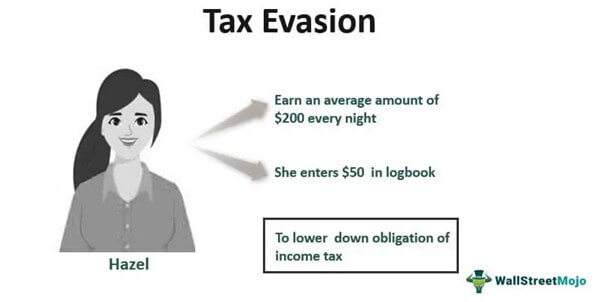

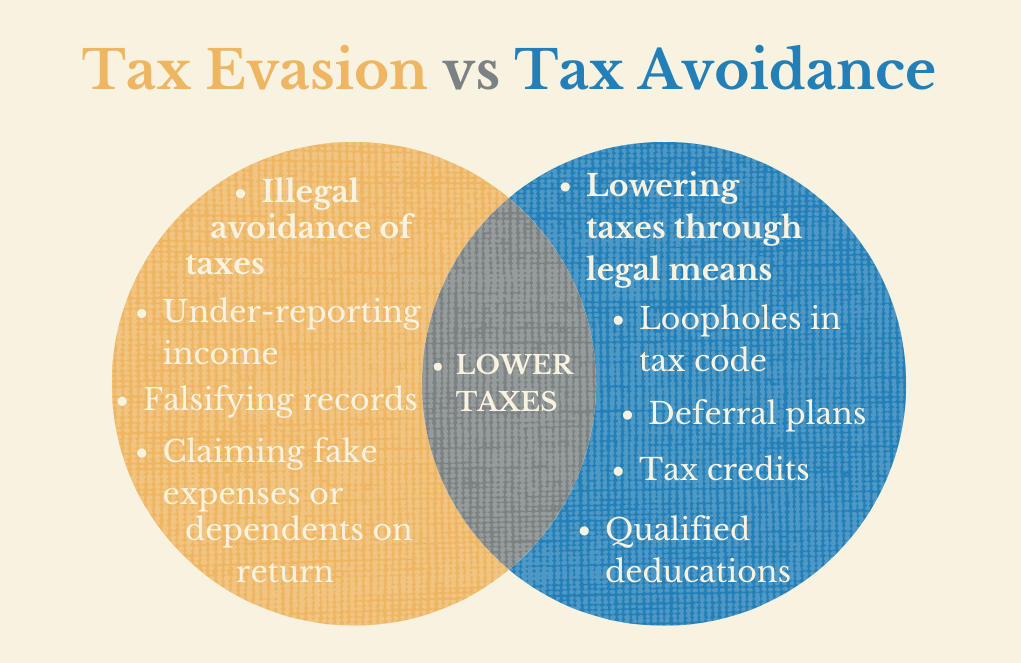

How to avoid tax evasion. The main difference between tax evasion and tax avoidance is that evasion is an illegal activity meant to deliberately dodge tax. Simplify rules/laws and the system as much as possible. Tax evasion is a very serious & avoidable criminal offence.

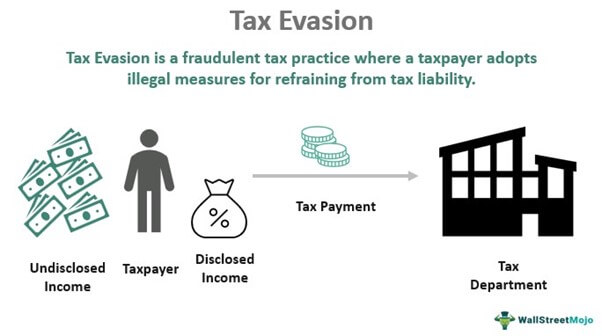

It is acceptable and even encouraged when individuals take lawful. It is important for the countries. Tax evasion is defined as the deliberate attempt to not pay tax amounts that are legally owed and is a crime for tax due in the uk.

Key differences in evasion vs avoidance. Tax evasion is a federal offense under the irs tax rules. Tax evasion is any attempt to avoid payment of taxes owed to the state through the use of illegal means or methodologies.

Tax evasion refers to the adoption of illegal methods for reducing the liability of payment of taxes, such as manipulation of business accounts, understating of incomes or overstating of. Being over 10% but not more than 30% of the tax payable;. Tax evasion involves deliberate and dishonest conduct.

Under the current criminal law in china, the avoided tax amount that is considered relatively high is defined as either: Nearly all tax strategies use one (or more) of these strategies to structure transactions to obtain the lowest. People who commit tax evasion can face.

Tax avoidance is working with the tax code of the country where you’re obligated to pay taxes to reduce the amount you owe. If the authorities suspect that tax evasion is occurring in your business, it’s important to cooperate. The most effective ways to avoid tax evasion.

/tax-avoidance-vs-evasion-397671-v3-5b71dfc846e0fb0025e54177.png)