Peerless Tips About How To Fight Property Taxes

Taxable property in the u.s.

How to fight property taxes. According to a recent study by zillow, a u.s. According to a recent study by zillow, a u.s. The first thing to do is check the record card.

Give the assessor a chance to walk through your home—with you—during your assessment. Your property taxes will be aggressively protested every year by the #1 property tax firm in the country. 5 hours agonaperville public library’s proposed 2023 budget calls for a 4.25% increase in property taxes — about $650,000 more than collected this year.

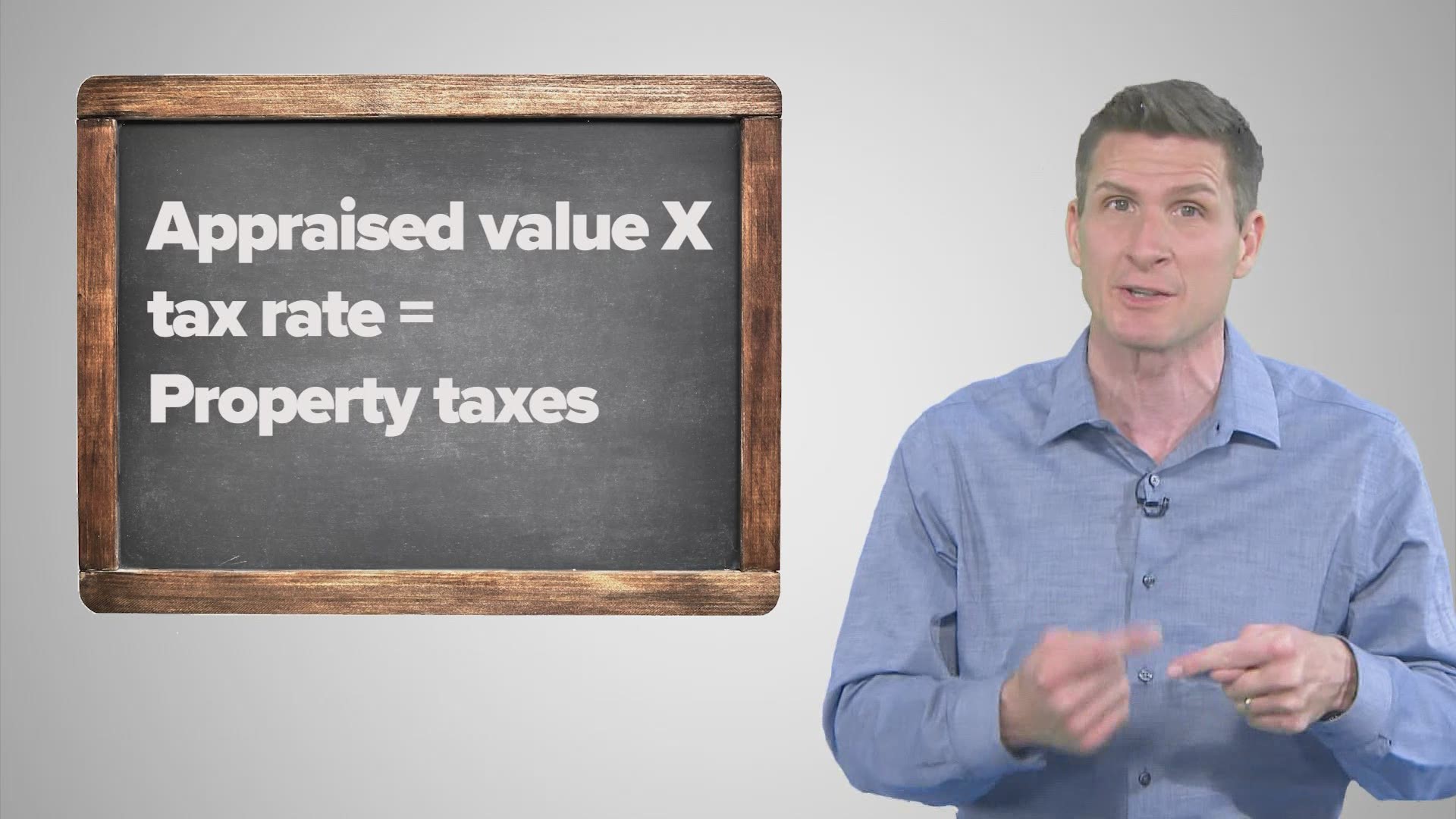

Property owner pays an average of around $2,800, or approximately 1.4 percent of their home’s value each year in property taxes. The county can accept, reject or propose a different value. Your locality also sets its own appeal process for property owners to dispute tax assessments.

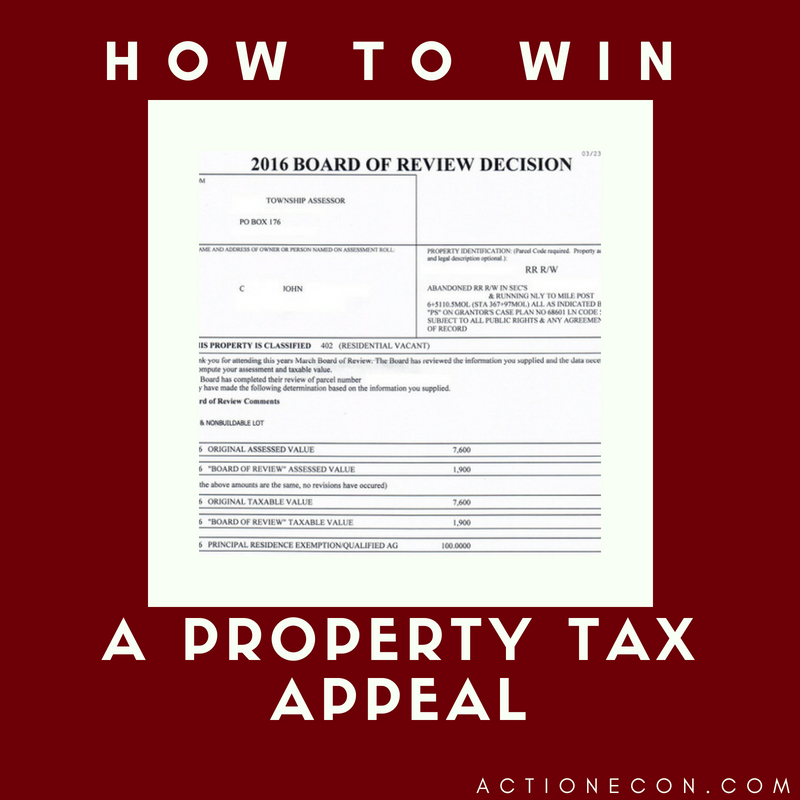

7 hours agoto counter rising property taxes, the campaign proposed allowing families earning less than $400,000 per year — and singles earning less than $200,000 — to deduct up to. Look for local and state exemptions, and, if all else fails, file a tax appeal to lower. If you do not fight your property taxes in a down market, don’t expect the property assessors office to automatically lower your property taxes.

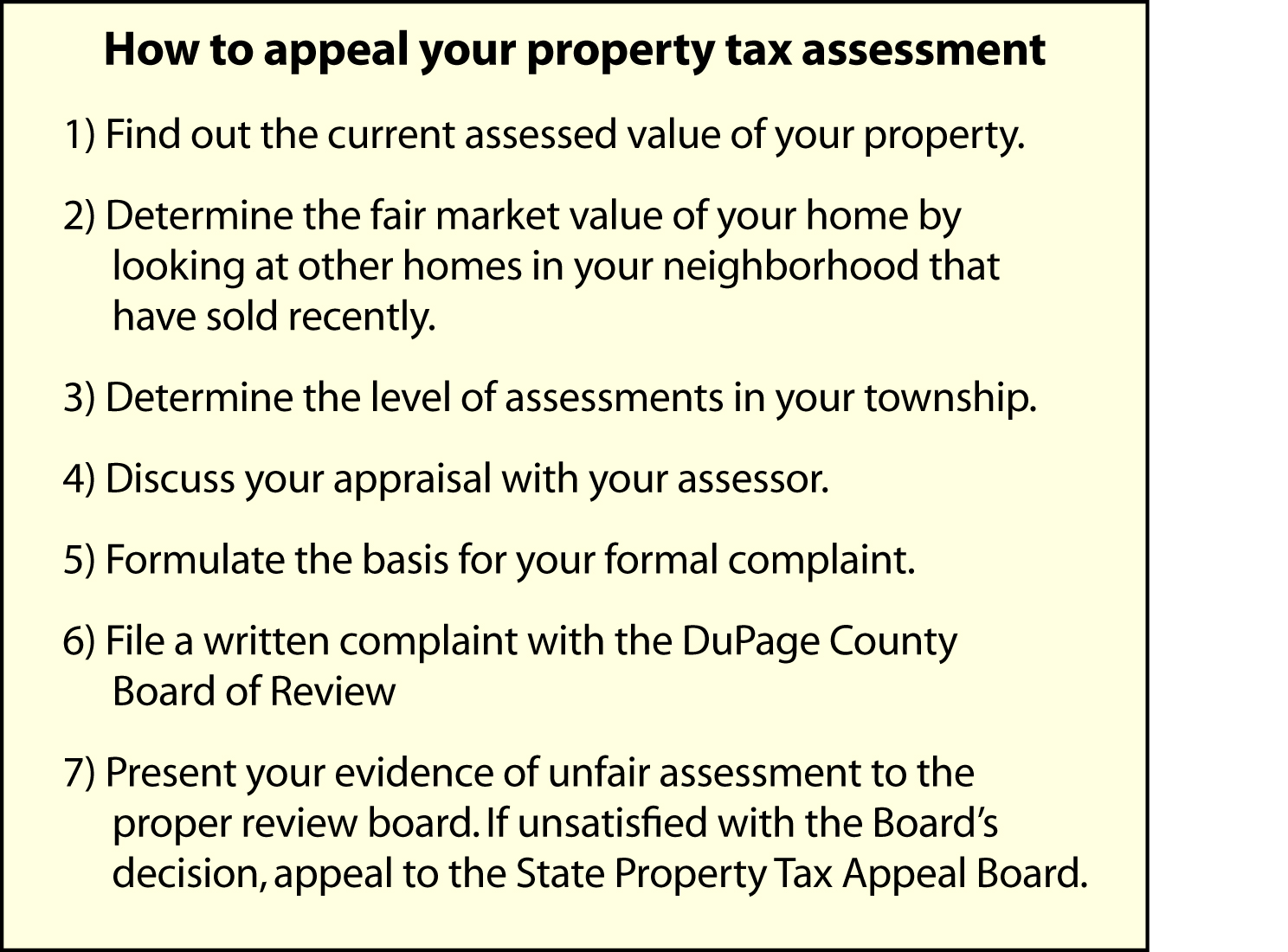

You must file a property tax. Once you have a basic understanding of the. No matter where you live in the united states, if you own real estate, you must pay property taxes.

In some cases, it simply means filling out a form and submitting it. The extra charges of a government on the purchasing of property in the form of general country tax can be eliminate easily with in a seven days according to the rules and. You can generally pursue tax relief in one of two ways: